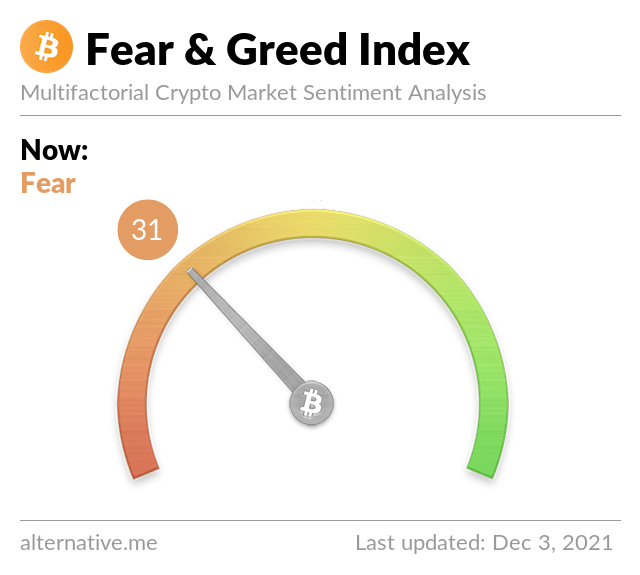

The Bitcoin fear and greed index is based on five factors: volatility, market momentum, social media, and dominance and trends. This index had recently hit its lowest level since March 2020, when the price plummeted nearly 40%. Bitcoin rose over 5.7% throughout the night and was trading at $52,700. Its current level is the highest it has been since March 2021. The chart below shows the overall market sentiment over the last year.

The current score is 37 out of 100, indicating extreme fear, while excessive greed shows unnecessary buying. In a nutshell, a high fear score means the market is likely to rise again in the coming days. The other half of the index is based on trends, measuring how frequently searchers search the Bitcoin name on Google. These trends, when high, signal extreme fear and greed. The fear and hunger index is an important factor for investors interested in the crypto market.

The BTC F&G index is a good way to gauge the overbought and oversold state of the cryptocurrency market. The index can be compared to a price chart to see how much the market is overbought or oversold. When the value of a cryptocurrency falls below a certain level, this could signal a market correction. It is good to monitor the BTC fear and greed index for these reasons.

The Bitcoin fear and greed index is calculated using seven factors that measure the price’s sentiment. These factors are all based on percentages, but they are never 100% accurate. Because of this, the Bitcoin fear and greed index is more of a crowd market-time tool than an objective indicator. If the BTC price dips below its target, the Bitcoin fear and panic index will jump into the extreme fear territory. This can be a sign of a rising market.

The Bitcoin fear and greed index is a measure of public sentiment. A score of zero indicates extreme anxiety, and a score of 100 shows pure and excessive greed. A score of 24 or less means that the market is not overly fearful or overly-sold, and a score of 50 or higher indicates extreme caution. In other words, the Bitcoin fear and grief index can tell when the market is safe. It is a good tool to gauge how the price has changed.

While several factors affect the Bitcoin fear and greed index, the main factor that drives the index’s movement is the price. When a market is experiencing extreme anxiety, it is good to sell quickly. A high score means that the market is oversold. A low score means that there is more risk for a crash. But this is not the case every time. The Bitcoin fear and greed index can show the positive and negative aspects of the crypto market.

When it comes to the Bitcoin fear and greed index, it can indicate a potential buying opportunity or a market correction. A high value indicates high demand and low price, while a low value means oversold the market. In addition to the price chart, the Bitcoin fear and greed index can be plotted on the Bitcoin price chart. This will allow you to see how the score changes over time. If it’s low, it could signal a potential buy opportunity.

The Bitcoin fear and greed index is based on seven factors. The first factor is dominance. This refers to the number of bitcoins in circulation. If it’s high, it means that the market is oversold, while a low score indicates that it’s undervalued. The two factors can predict the same thing. On the other hand, a low score means that it’s overvalued.

The Bitcoin fear and greed index is calculated by measuring six investment indicators and weighting them according to their impact on the price of Bitcoin. In general, an oversold index is a signal of extreme fear. An oversold index means that it’s a good time to buy. On the other hand, a high value means that it’s an oversold market. However, a low value suggests that a high price offers a high level of demand.